how are property taxes calculated at closing in florida

Property values are usually determined by a local or county assessor. When it comes to real estate property taxes are almost always based on the value of the land.

Closing Costs Calculations Practice Video Lesson Transcript Study Com

Property taxes in Florida are implemented in millage rates.

. This amount can differ greatly from one agent to another but it is typically 25-3. Documentary Stamps These are often called doc stamps and except in Dade County their price is based simply on the sale price of the home. Heres how to calculate property taxes for the seller and buyer at closing.

This determines the value of the home for loan purposes. As stated before the property taxes in Florida are based on the amount required in the previous year. In Miami-Dade its 60 per 100 for a single-family home.

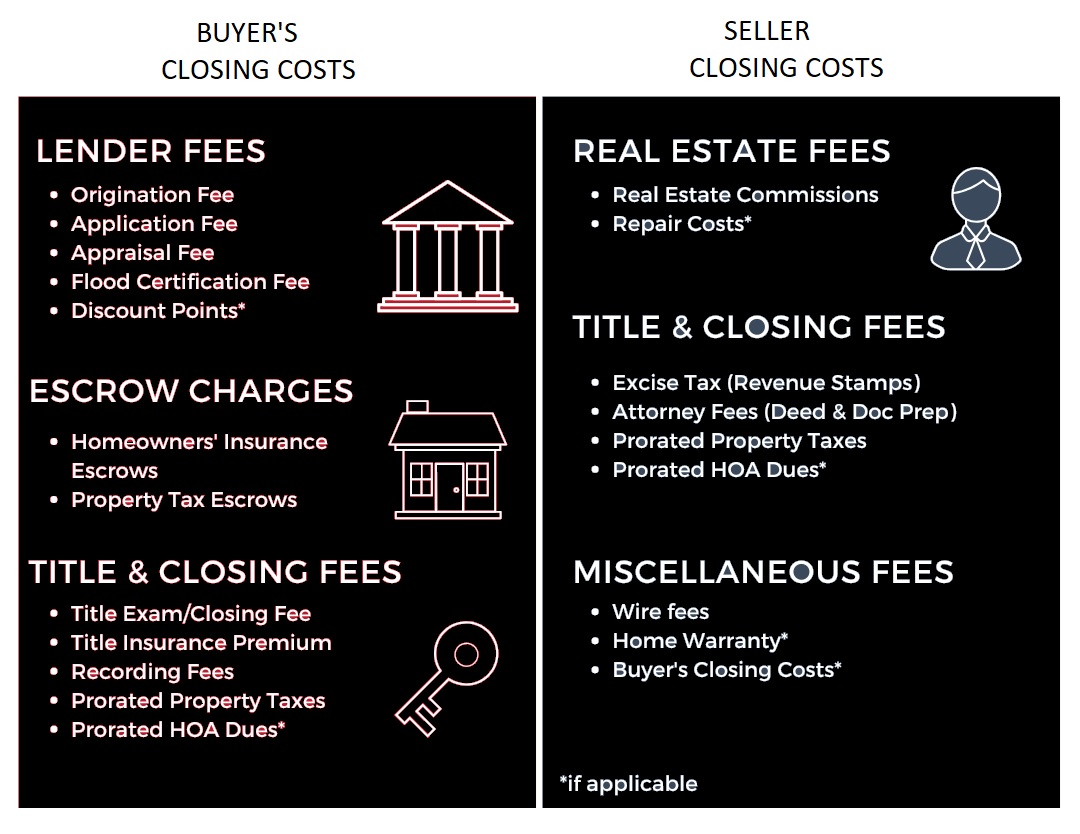

At closing it is typical to use the maximum discount allowed when prorating taxes. Everywhere in Florida outside of Miami-Dade County its calculated at 60 cents per 100 of the value on the deed. Based on the price of the property Lender Charges Determined by your lender State and Local Taxes State Mandated Formula Inspections and Surveys 3rd Party Vendors Buyers and Sellers Charges In Florida similarly to other states closing costs are charges that applied to both parties in a real estate transaction the buyer AND the seller.

Divide the total monthly amount due by 30. To calculate the property tax use the following steps. Based on those numbers getting the per diem ie the per day amount for our calculations is easy divide 477965 by 365 130949day.

Find the assessed value of the property being taxed. The buyer typically pays between 3 to 4 of the home loans value and is responsible for the bulk of the fees and taxes. In Florida transfer taxes often referred to as doc stamps come into play for the vast majority of real estate transactions and are usually borne by the seller.

Common Florida Seller Closing Costs. Heres an overview of the closing costs you can expect to pay when buying a home in Florida. Real Estate Agent Commission typically 5-6 of the sales price.

Counties in Florida collect an average of 097 of a propertys assesed fair market value as property tax per year. Tax amount varies by county. In Miami-Dade County its calculated at a rate of 70 cents per 100 of the property value on the deed.

Appraisal fees these are usually between 300 and 500. During the closing process all parties typically sign a re-proration agreement which states that the property taxes will be re-calculated upon the arrival of the tax bill. If thats the case in your area youll pay property taxes at closing for the portion of the year that you owned the property.

As stated before the property taxes in Florida are based on the amount required in the previous year. You Should Let Marina Title Handle the Details Here Is Why. Transfer taxes would come out to.

This way when a tax bill arrives the parties involved in a real estate transaction should re-prorate the taxes to determine which party owes what. Florida is ranked number twenty three out of the fifty states in order of the average amount of property. Neither party is responsible for 100 of the closing costs in Florida which includes fees taxes insurance costs and more.

So when a home closes before the property tax bill arrives the title company will need to prorate taxes based on what the taxes were in the prior year. The actual amount of the taxes is 477965. So if you take out a mortgage worth 200000 to purchase a home youll pay roughly 3900 in closing costs.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Luckily the system counts the number of days from Jan 1 through Oct 28 301. As mentioned above property taxes are not assessed until November of the year in which they are due.

Property Tax Closing Costs in Florida How to Calculate the Required Amount. Divide the total annual amount due by 12 months to get a monthly amount due. Heres how to calculate property taxes for the seller and buyer at closing.

A number of different authorities including counties municipalities school. 4200 12 350 per month. For the Florida median home value of 252000 this comes to 1512 outside of Miami-Dade or 1764 inside Miami-Dade.

Elsewhere the rate for this excise tax is 70 per 100. Then when the actual tax bill arrives the buyer and seller pay or are refunded the difference. That way the buyer doesnt have to pay taxes for the entire year when they only owned it for a few months.

In Florida the average closing costs come to approximately 198 of the home purchase price. This means that if your closing takes place anywhere between January and the first week of November the amount of the current years property taxes will not be known. 350 30 1167 per day on a 30-day calendar.

Property Taxes in Florida. A millage rate is one tenth of a percent which equates to 1 in taxes for every 1000 in home value. The more valuable the land the higher the property taxes.

Property Taxes at a Closing in Florida In Florida property taxes are paid in arrears. The seller usually pays between 5 to 10 of the homes sale price. Taxable Value X Millage Rate Total Tax Liability For example a homestead has a just value of 300000 an accumulated 40000 in Save Our Homes SOH protections and a homestead exemption of 25000 plus the additional 25000 on non-school taxes.

In Florida your county may collect property taxes for the current year at the end of the year. Property tax bills in Florida arrive in early November and are for the calendar year. Coletti explains that in most of the state the tax is calculated at 007 multiplied by the purchase price or 070 per 100.

If the propertys not a single-family home theres a 45 per 100 surtax added on. Optional survey fees normally between 300 and 500 some lenders require surveys of a property before theyll release a loan to a. Closing costs can increase or decrease depending on the home purchase price.

The taxes are assessed on a calendar year from Jan through Dec 365 days. Assuming you intend to leverage the expertise of a qualified realtor and the buyer also engages an agent to purchase your home youll be responsible for paying both of them at closing. Divide the total annual amount due.

097 of home value.

9 Hidden Costs Of Buying A Home Fidelity Home Buying Buying Your First Home Home Buying Process

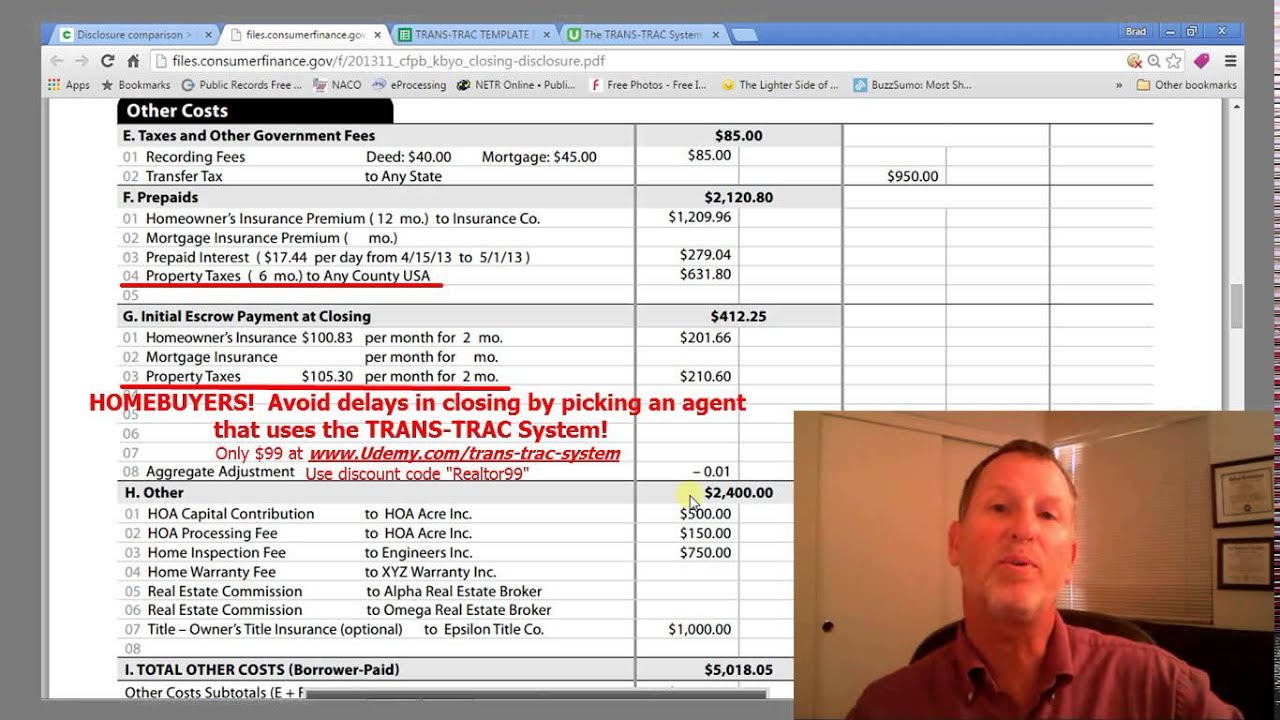

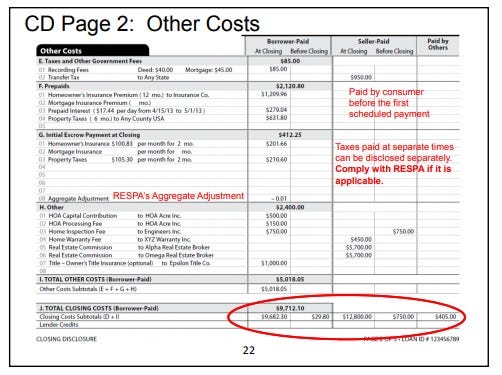

Wtf Is The Aggregate Adjustment On My Closing Disclosure By Jeffrey Loyd Medium

Account Suspended Real Estate Infographic Home Buying Buying First Home

Helpful Tips To A First Time Home Buyer From A First Time Buyer Buying First Home First Home Buyer Real Estate Infographic

Your Guide To Property Taxes Hippo

How To Calculate Property Tax Prorations Ask The Instructor Youtube

Your Guide To Property Taxes Hippo

Your Guide To Prorated Taxes In A Real Estate Transaction

Closing Costs That Are And Aren T Tax Deductible Lendingtree

What Should Homebuyers Ask Themselves Before Entering The Market Real Estate Buyers Home Buying Real Estate Buying

4 Things To Know About Closing Costs New Dwelling Mortgage

1sttimehomebuyers Home Buying Credit Card Realistic

Understanding Property Taxes At Closing American Family Insurance

Closing Costs In Florida What You Need To Know

Midpoint Realty Cape Coral Florida Brochure Call Us 239 257 8717 Or Email Admin Midpointrealestate Com Condos For Sale Cape Coral Florida Boxes Easy

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company